In case there is no information for a particular TDS / TCS Return that needs to be filed, one option is to file a NIL Return. The other and better option is to declare this on TRACES web portal. This may be done through the software.

Click on ‘TRACES’ > ‘Non-Filing of Return’

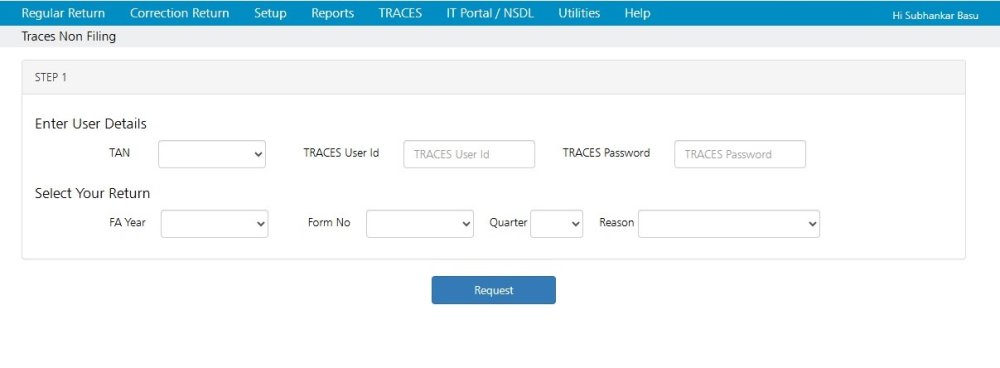

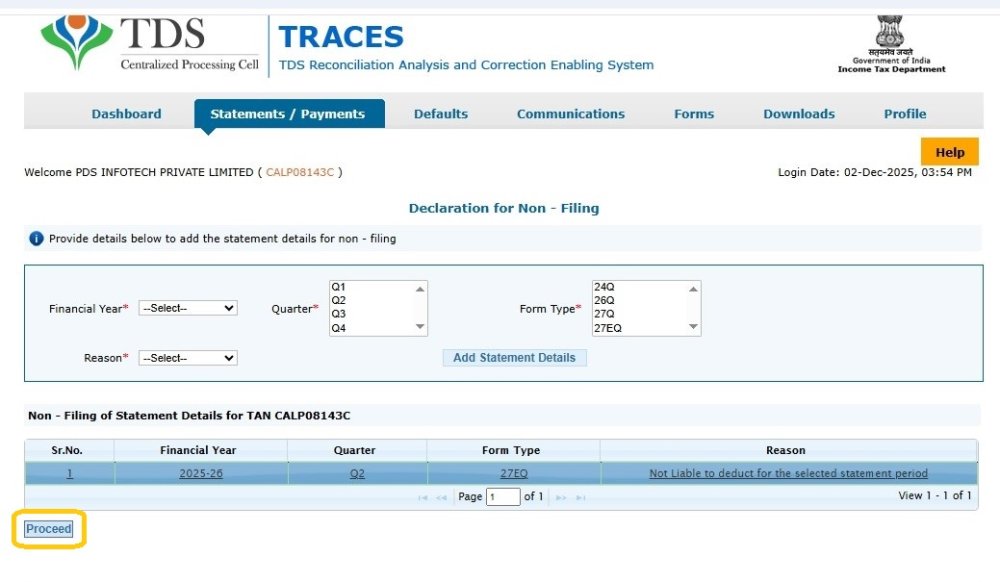

The following screen will get displayed :

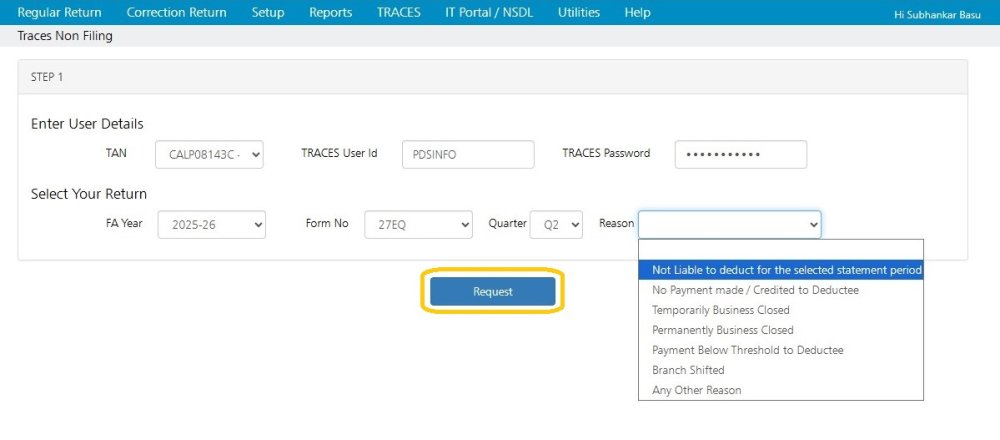

Select the TAN and Enter TRACES User Id and Password

Select the relevant Return

Select the Reason for Non-Filing, as shown below :

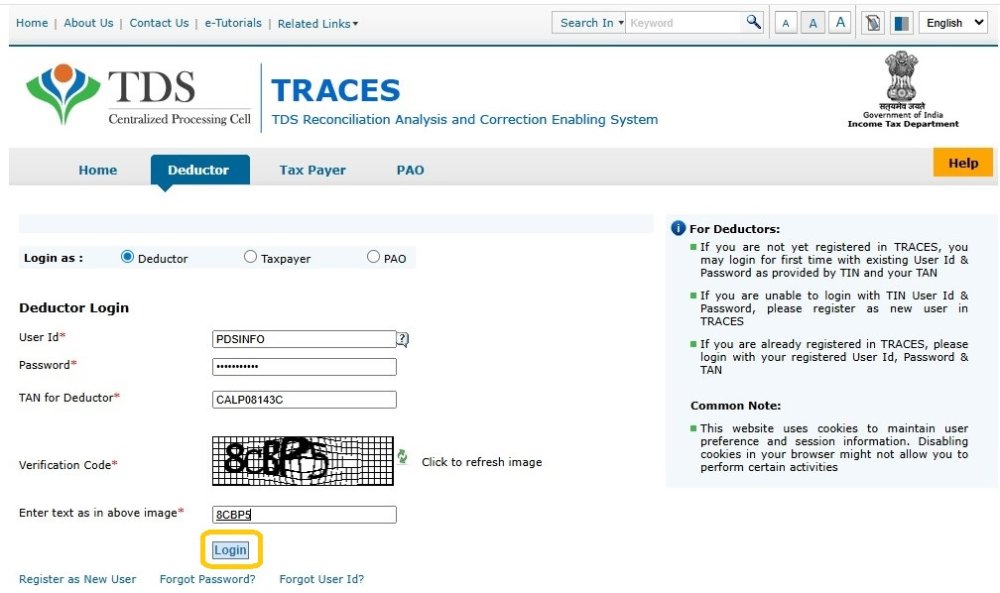

Click on ‘Request’. In the next step, login to TRACES, the following is displayed:

Enter the Captcha Code.

Click on ‘Login’

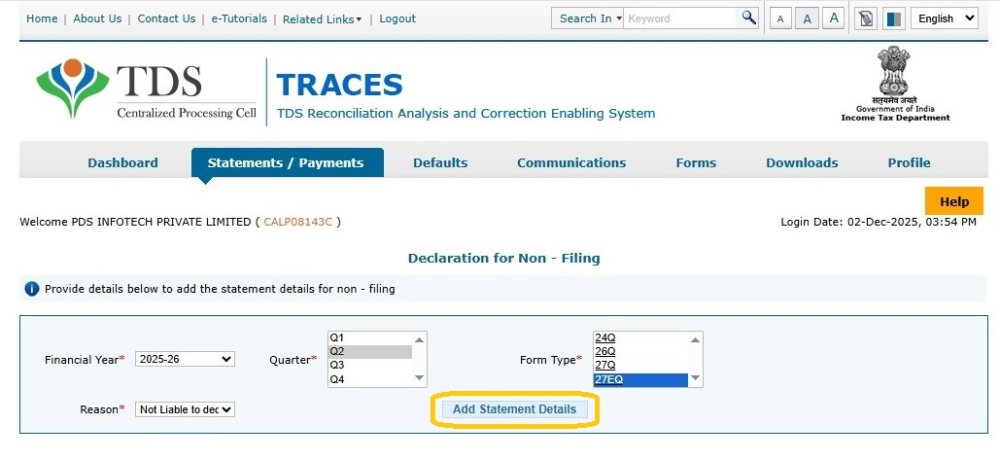

Provide details above to add the statement details for non – filing.

Click on ‘Add Statement Details’

The relevant statement will get added.

Click on ‘Proceed’.

Once it is successfully done, confirmation message will be displayed.

Need more help with this?

EnterpriseTDS - Support